December Retail Report: Special Edition

This time last year we could’ve never predicted the momentous changes that we would face over such a short period of time as retailers scrambled to survive amid a global pandemic. But the truth is the changes we’ve seen over the last ten months were just an acceleration of trends that were already in place: a further push to digital services and selling; lifestyle changes that keep us closer to home and family; and the need for our businesses to run lean. As we peek around the corner to 2021, we expect these changes to be refined as we learn which strategies are working best for this new reality.

But before we jump into what will hopefully be a much better year ahead, let’s take a quick look at what we went through, and what we learned.

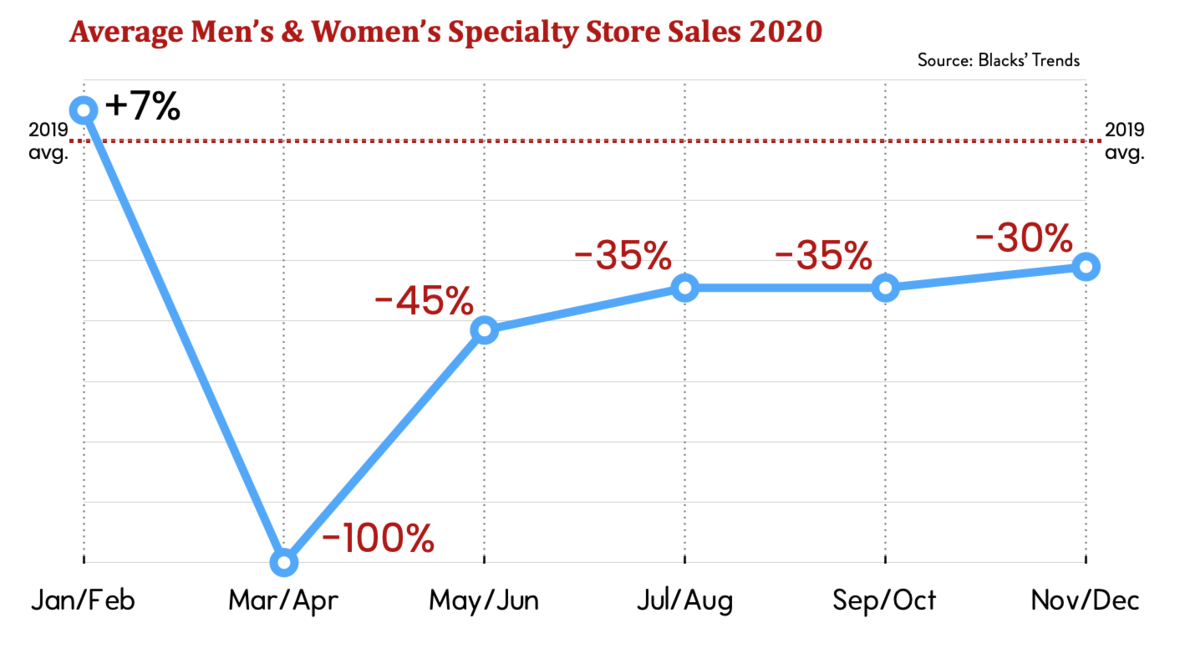

Average Men’s & Women’s Sales 2020

As stores recovered from complete shutdowns in the March to April period, they quickly developed new ways to sell and keep in touch with customers. Social media selling, Zoom appointments, curated boxes, and ramped up customer contacts using apps like OneShop (formerly Clientelier) became cashflow lifelines as they struggled to manage loan procurement and cut costs.

In October we surveyed specialty stores across the country to see which strategies were working, and what changes they were seeing in the retail landscape. Here’s what they said:

-

– After a drop off in sales of Clothing categories, they quickly switched to high-margin Activewear and Athleisure.

– The number of vendors they’re working with shrank, but they formed tighter partnerships with those who remained.

– Throughout 2020 in general womenswear merchants performed better than men’s, and in many cases were quicker to adopt new online selling strategies.

– Some menswear only merchants added womenswear categories to balance out their sales.

– Most merchants expected a return to semi-normal by late spring of 2021.

December Sales

Here’s where we stand at the end of this doozy of a year. Year-to-date, stores were down 37% on average, with an average 32% decline from “normal” in December. Keep in mind that there are some stores that really outperformed these numbers, especially in the women’s sector. Throughout the year stores that started out poorly never recovered, while the ones that managed to do a quick pivot to smart selling continue to outpace others.

As we kickoff the New Year, make sure you don’t carryover any old inventory. Clean up your on-order files and focus on your FA’21 sales plans. It’s time to make up for lost sales during the pandemic.

The New State of Fashion Retail

After working with independent retailers across country for the past year, here are our insights. Hopefully they will help you and your staff conquer the year ahead.

Rise of Casual, Near Death of Clothing—This has been a slow-moving trend for several years now. Consumers’ shift to experiences over products meant that fewer shoppers were building out extensive formal wardrobes. At the same time, younger shoppers tended to stick with a few tried-and-true dressy outfits for formal events. Now, with most people working from home, and most formal events canceled for the near future, Clothing categories are on life support.

While we do expect to see a rebound once people start traveling and holding formal events again, it is unlikely to be sustained, especially for men. A single dark suit can get them through most formal occasions. This means that merchants need to shift to other casual or sporty categories—many have already started this change, so finding new and interesting vendors is essential.

Social Selling Is Here to Stay—During the store closures many retailers dipped their toes into social media selling for the first time. What they found is that it is a great way to connect with customers, even if the actual payments are done elsewhere (over the phone, or via their website.) Women’s operations were generally more successful than their menswear counterparts, and part of this is due women being more engaged and open to shopping on social channels. Still, this is one part of a multi-pronged strategy that no merchants should ignore. According to one study, 78% of salespeople engaged in social selling are outselling their peers who aren’t.

Mass Personalization—More brands and e-commerce sites are keying into what made our specialty stores special all along: personalization. Vendors like Zegna have moved into personalized sportswear, and items that previously weren’t made custom (like sneakers), now offer personalization options. While this is a fun space for consumers to play in, this doesn’t mean that the personal relationships in our brick-and-mortar stores aren’t just as, or more important. Combine a trusted salesperson with a customized product and it is a win-win. We learned this long ago selling custom Clothing, but now we have to expand into new categories.

Inventory Stays Right-Sized—One of the biggest challenges we have working with the new clients is trying to get them to trim their inventory levels. Many retailers believe that the more they have on the floor, the more they will sell, but this isn’t necessarily the case. With a shortage of goods and declining demand many fashion retailers cut back on their inventories significantly in 2020 and found that they could do a good level of business with around 70% of the merchandise that they carried previously. This allowed them to sell through the inventory more quickly, increase their turn rates, and minimize their markdowns. With this coming year still carrying a lot of unknowns, we expect right-sized inventories to continue. This is one strategy that merchants should hold onto post-pandemic, although from experience we know some will be very tempted to return to over-inventoried levels as soon as they can.

Another strategy we’ve been preaching is to hold all orders before releasing them, once you have assessed shorter-term demand.

A Divide on Buying—With in-person trade shows canceled and delayed over the last year, vendors shifted their markets online in a big way. This enabled merchants to buy without traveling, saving money on both sides. However, from what we’ve heard from many retailers, buying clothes without getting to touch them, feel them, and try them on, was frustrating to say the least. It led to them are receiving some merchandise that did not fit up with their expectations, resulting in more returns.

We believe that the markets and vendors would prefer to stay mostly online, for reasons of cost and convenience. However, retailers are itching to get back to in-person shows. Both options are likely to be available in later 2021, and then we will see who wins this battle. One thing is for sure – many vendors are now going direct to consumer, skipping retail altogether. This means that many of our merchants need to find new supply chains and partnerships, with shared goals and expectations.

2021 Tips

While you give some thought to the trends we see above, here are some more practical, real-world tips as we tackle this exciting new year:

-

– Get your customers back into the habit of buying. Plan events and campaigns that keep them engaged. Focus on fun, talk to your clients now about their life events (weddings, anniversaries, etc.) or desires for the second half of the year.

– Do everything you can to find new vendors and exciting products. Newness is key to growth this year.

– Look at your 90-day trends, and continue to fund the best-performing categories.

– Keep it personal. Set customer contact goals and monitor your success.

– Know that the first quarter will likely be a struggle, but then you have nowhere to go but up. What kind of credit and help do you need to get you through the first few months of the year? Start asking.

– The new Paycheck Protection Program (PPP) loans are easier to apply for and more directed at small businesses, with fewer than 300 employees. They cap out at $2 million and have a special pool of money for businesses with fewer than 10 employees. Apply right away if you need help.

Conclusion

Although 2021 will surely be another unusual year, we are not going in blind. We know which strategies are working, and we can build on them. Keep working on shorter term trending and sales planning, so you can better ride the waves of demand.

As always, if you need help, give us a call. Our online planning Portal allows you to view and track your trends, as well as measure your progress against stores across the country.