All said, 2024 was a pretty good year for our apparel merchants, particularly in menswear.

According to client data from across the country, sales of women’s wear came in even against last year, while menswear made an impressive 6% gain overall.

Let’s take a closer look at where we saw the most growth, and which categories lost momentum.

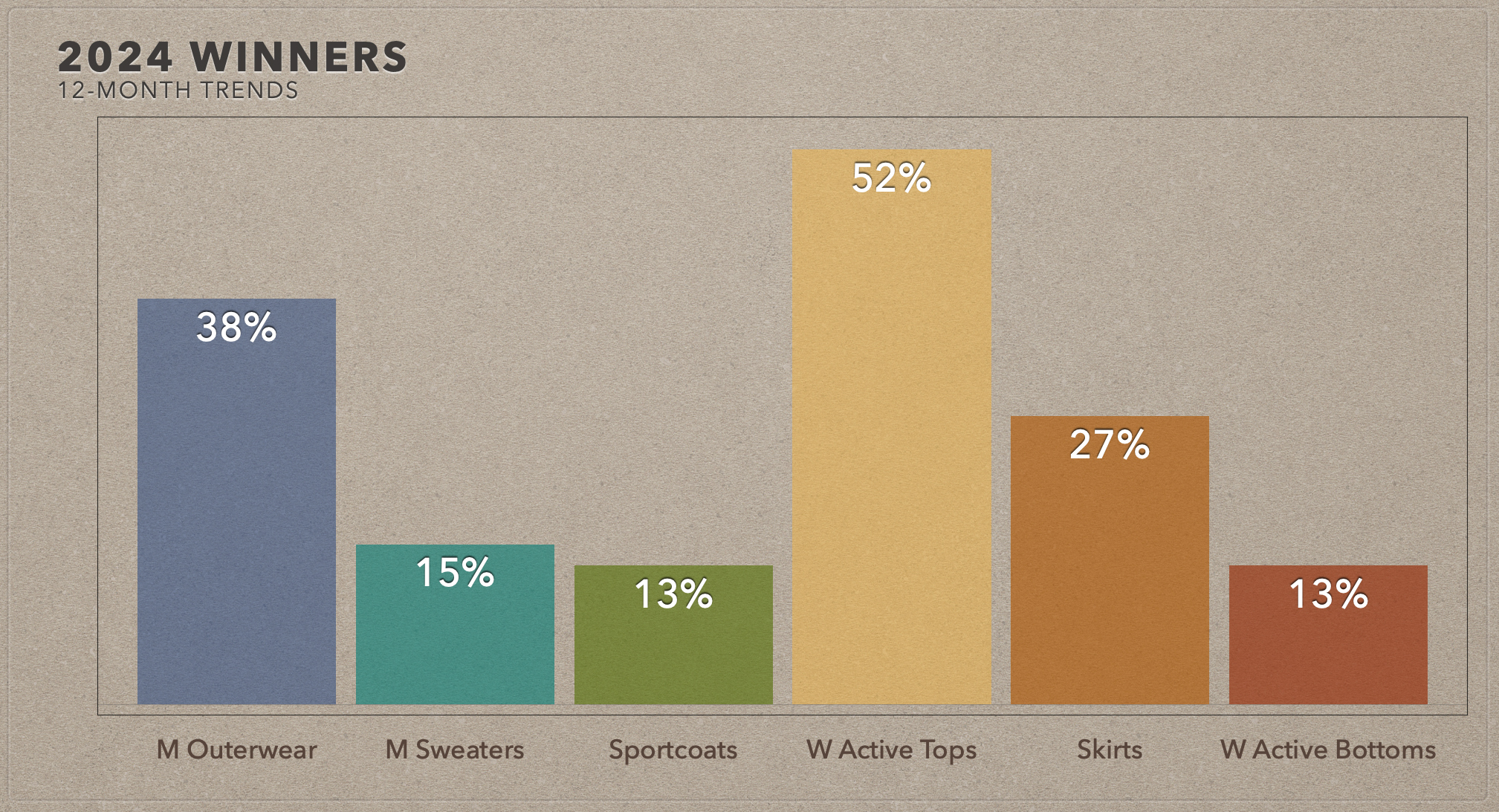

In menswear, outerwear and clothing continued to thrive. We saw the biggest gains in topcoats/rainwear (38%), sweaters (15%) and sportscoats (13%).

Men’s activewear saw the biggest drop, down 16%, as customers decided they could make do with what was already in their closets.

In women’s, it was the opposite story when it came to activewear. Women’s active tops and bottoms spiked for the full year (52% and 13%, respectively), but both lost momentum in the last 90 days.

Outside of activewear, dress sales continue to be sluggish, but skirts soared, up 27% for the year. Tops also did well, coloring in the story that women wanted separates.

Some women’s stores lost a chunk of revenue from a decline in special orders (down 9%), while men’s stores made gains in the same category (up 9%).

Spring/Summer ‘25

Looking ahead, we believe there’s room to grow in knits, sweaters, and casual pants.

On the men’s side, consider how many 5-pocket pants you want to buy upfront. Sales have been a bit choppy recently, and many stores have too much inventory.

You may want to re-balance your supply of denim vs. 5-pocket vs casual pants. Although 5-pocket pants have led sales in the past, recently we have seen more momentum in casual pants.

On the women’s side, we expect sweater and dress trends to mirror last year, where spring sweaters sold for longer.

We suggest you land your spring sweaters early and do fill-in orders for best sellers as the season progresses.

Dresses did not really start to move until the weather improved in early spring. This category is seeing seasonal spikes, but is not as strong as it was in years past.

The key overall, of course, is looking for a little bit of newness in all your apparel categories. This could be intricate details, seasonal colors, and new vendors with a different point of view. We haven’t seen any strong trends that bring new life to the market in a while, so it’s up to our merchants to find some innovation.